A comprehensive 12-step guide to buying a home

Like many, you may dream of owning your own home or condominium. A place to call your own where you can renovate, create a garden, relax on warm summer days and do things your own way. Pure bliss! Nevertheless, this ambitious project involves many steps, which can seem daunting: budgeting, the down payment, mortgage approval, searching and attending showings, making an offer, the inspection, dealing with a notary, moving, maintenance...

- Identify your needs before buying a property

- Find a real estate broker

- Decide on your home-buying budget and save for a down payment

- Find out about grants, tax credits and incentives that can help you buy a property

- Get pre-approved for a mortgage

- Start actively searching and visiting properties

- Make an offer or promise to purchase

- Get a pre-purchase home inspection

- Fill out a mortgage application and learn about mortgage types

- Prepare for your appointment with the notary and understand the documents to be signed

- Organize your move and take possession of your home

- Maintain your home and plan renovations

- Other considerations before buying your home

- In conclusion

- Home-buying FAQs

So many details to consider! To help you better prepare for this unique adventure, we have created a comprehensive twelve-step guide to buying a home.

1. Identify your needs before buying a property

Determining your needs BEFORE buying a property is the first step in any home-buying project.

- Location

Choosing your future neighbourhood or city is an important first step. Where would you like to put down roots? Do you want to be near your workplace and schools? What kind of neighbourhood appeals to you? Would you like to be close to interesting activities? Do you prefer the city, suburbs or somewhere more rural? Are you looking for a trendy neighbourhood?

- Transportation and parking considerations

Parking in the city can be a real hassle, but public transportation is easier. What are you looking for?

- House size, number of rooms, basement or not, etc.

How many people will be living there? How many children? Will they each have their own room?

- Special features: swimming pool, elevators, waterfront access, etc.

For some, a pool is too much maintenance. For others, it’s a big plus. What are you looking for?

- A self-build project, something brand-new or an older construction (with or without renovations, year built)

Your preference will depend on many factors: do you have the time and skills to build your own home? Do you want to be able to move in and have nothing to fix, or can you handle a few renovations?

What type of property would you like to buy?

There are two main dwelling types: condo and house.

- A condo is a residential unit within a larger co-owned building or complex. You own your unit and have access to the common areas (corridors, elevators, etc.) shared by the co-owners. There are also condo fees, which pay for the maintenance of these common areas.

- A house is an individual property with its own yard. As the sole owner, you have more privacy but are entirely responsible for maintaining your house and grounds.

A condo includes more shared amenities, whereas a house offers more independence and responsibility. It’s up to you to determine what is best!

It is important to distinguish between actual needs or essentials and what would be nice to have but is not necessary. Take the time to make a list.

If you are buying a property with someone else, discuss your must-haves with them before you begin looking at different possibilities. This will help you search for a property more efficiently. Speaking of searches, are you familiar with the Lifestyle feature on Centris.ca?

|

Tips and tricks Centris.ca lets you choose from 9 property types. Whether you want to live in a condo, co-op, townhouse, semi-detached or detached home, or some other building type, you can use the filters and the Lifestyle feature to find it. |

2. Find a real estate broker

It's a good idea to start looking early for a real estate broker who meets your needs, especially given the size of a real estate investment and the potential complexity of transactions, even for experienced buyers. Using a real estate broker to purchase a property is beneficial in many ways during a transaction.

| “ | A real estate broker does more than just find you a home. He assists you in every aspect of the buying process, from the initial search to the closing of the transaction. He helps you clarify your needs and preferences, suggests properties that match your criteria, organizes visits, negotiates purchase offers, advises you on market prices, guides you through the administrative and legal procedures, and accompanies you right up to the signing at the notary's office. |

| Jessica Lavoie, Communication and Marketing Director at the Quebec Professional Association of Real Estate Brokers (QPAREB) |

In addition, real estate brokers are obliged to represent their clients in their best interests, and are governed by the Real Estate Brokerage Act, offering significant protection. They also have access to a vast network of experts, such as mortgage brokers, whom they can recommend to clients at the right moment in the transaction. Your real estate broker will save you time and money, give you sound advice based on the real estate market, and accompany you every step of the way.

How do I find a broker? Consult the Centris.ca directory and use the territory filter to refine your search.

|

Tips and tricks By creating an account on Centris.ca, you can identify your broker so that he or she has easy access to your saved searches, favorites and alerts. This way, he or she can easily understand your preferences and offer you personalized support. |

3. Decide on your home-buying budget and save for a down payment

In today’s market, a home-buying budget is a must. Do you know your borrowing capacity and credit score?

In order to borrow to purchase a property, your credit report needs to be good, if not excellent. When mortgage lenders assess whether you can afford a home, they check your gross debt service (GDS) ratio and the percentage of your monthly household income that covers your housing costs and any other debts (TDS). These should be limited to 39% and 44% respectively.

Which brings us to the down payment. How much do you need to save for it? The amount will depend on the price of the house and is deducted from the total purchase price when the sale goes through. If you can’t afford 20% of the purchase price for the down payment, you will need mortgage loan insurance. That’s where the CMHC premium comes in.

|

|

|

|

Property purchase price |

Minimum down payment |

|

$500,000 or less |

5% of purchase price |

|

$500,000–$999,999 |

5% on first $500,000 |

|

$1,000,000 or more |

20% of purchase price |

Although buying a home in Canada requires a minimum down payment, there are various ways to finance your down payment.

Of course, if you purchase a home with a spouse, you will need to determine the amount of each person’s contribution. This is especially true if you are common-law partners.

First, determine each person’s share based on their financial contribution. This can be 50/50 or proportional. Next, discuss expenses, renovations and maintenance, decide how each person will contribute, and create a joint budget. Planning your home-buying project in advance helps to ensure a harmonious partnership and efficient management.

Besides the mortgage and down payment, there are other costs associated with buying a home such as the so-called welcome tax, notary and inspection fees, moving expenses, condo fees (if applicable) and maintenance costs.

|

|

|

|

Non-recurring expenses |

Cost estimate |

|

Welcome tax |

Based on the municipal property assessment |

|

Notary fees |

$1,000–$1,500 |

|

Inspection fee |

$750 - $850 for a single-family home |

|

Moving expenses |

$100–$150 per hour for 2 movers |

|

Condo fees (if applicable) |

Based on the condo’s value |

|

Connection fees |

Depending on your service providers and packages |

|

Recurring expenses |

Cost estimate |

|

School and municipal taxes |

Based on property value (paid yearly) |

|

Maintenance costs |

1–3% of the home’s value |

|

Home insurance |

Based on property value |

Do you have a low income and are worried that you won’t be able to afford to buy a home? Don’t lose hope—there are ways to make it happen. If you’re not able to buy a house right now, rent-to-own could be a worthwhile option.

Use this calculator to determine your borrowing capacity.

|

Tips and tricks Unsure of how much you would be comfortable borrowing to buy your first home? Try this: over a few months, set aside the amount that you would need to spend on a new home. This is a good way to determine if buying is feasible for you financially. |

4. Find out about grants, tax credits and incentives that can help you buy a property

Buying a home can be made easier with a little extra help. Depending on your situation, you may qualify for some of the credits, grants and financial assistance programs available to home buyers. There are even a number of renovation subsidies available .

|

|

|

|

Name |

Percentage or amount |

|

$1,400 |

|

|

First-Time Home Buyers’ Tax Credit — Government of Canada — HBTC |

$1,500 |

|

Programs offered by cities, municipalities or boroughs |

Depending on your city |

|

Maximum rebate: 36% of GST paid and 50% of QST paid |

|

|

Partial refund of the 25% premium if you’re CMHC insured and spending at least $20,000 in energy-efficient renovations. |

|

|

$2,000 |

|

You may also qualify for other home ownership programs. For example, the new multigenerational home tax credit may be of interest if you’re looking to buy a home with family.

5. Get pre-approved for a mortgage

Before you start house hunting, it’s a good idea to get pre-qualified, or better still, pre-approved for a mortgage. What is the difference?

- A mortgage pre-qualification estimates the maximum loan a lender could grant you.

- A mortgage pre-approval is an offer by the lender to lend you a certain amount.

How to get pre-approved for a mortgage

This process helps you

discover your borrowing capacity and estimate mortgage payments, guaranteeing

an interest rate for the following 60 to 130 days. Getting pre-approved for a mortgage before you begin house hunting

helps you be better prepared!

To begin the pre-approval process, you will need to provide the following documents or information:

- Proof of ID

- Assets (what you own: cottage, car, boat)

- Proof of employment (current salary, position and notice of assessment)

- Debt load and financial obligations (credit card balances, child support, loans, lines of credit, other debts)

- Proof you have the down payment.

You can choose to apply directly to a lender or seek the help of a mortgage broker. The mortgage broker’s role is to find you the best rate from among the different lenders and to advise you on your mortgage. Remember to find out when the pre-approval expires, the current interest rate, terms of payment, penalties and prepayment. You can save a lot of money by comparing the various options offered by different lenders, such as banks, caisses populaires and credit unions, as well as mortgage insurance, trust or loan companies.

And if you don’t get approved, there are still other options to explore. Your broker or financial institution will be able to advise you on various solutions, including reducing the loan amount requested, increasing the down payment, finding a mortgage co-signer or opting for a higher interest rate.

|

Tips and tricks Find out whether you will automatically benefit from a lower rate if interest rates drop during the pre-approval period. It could make a big difference! |

6. Start actively searching and visiting properties

Perhaps you've already begun your search for the home of your dreams. To find properties, start by visiting Centris.ca. In addition to being the site with the largest number of properties in Quebec, there are a variety of functions and filters for searching on Centris.ca, as well as alerts. Use the Map View to find properties in your chosen neighbourhood, or use the Lifestyle function to find out more about the neighborhood of the property that has caught your interest.

When you visit a property, you will be given a copy of the Declarations by the seller form. Why is that useful?

Sometimes given right before the showing, the Declarations by the seller document gives the buyer detailed information on the condition of the property and its history. The seller must complete this form to the best of their knowledge. The purpose of this document is to protect both the buyer and seller.

Questions to ask when visiting a property

While viewing the house, don’t be afraid to ask the real estate broker or the owners, if they are present, any questions you may have:

- Why is the house for sale?

- How long has it been on the market?

- How many offers has the seller received?

- Are there any structural issues?

- Has the seller done any renovations themselves? If they hired a professional, is there proof of the work done?

- When were various renovations last done (roofing, siding, etc.)?

- Has the house ever been damaged, for example from water infiltration, flooding, fire or something else?

- What is included in the sale of the house?

- What is the neighbourhood like?

- What is the seller’s timeline?

- What are the utility costs (heating, electricity)?

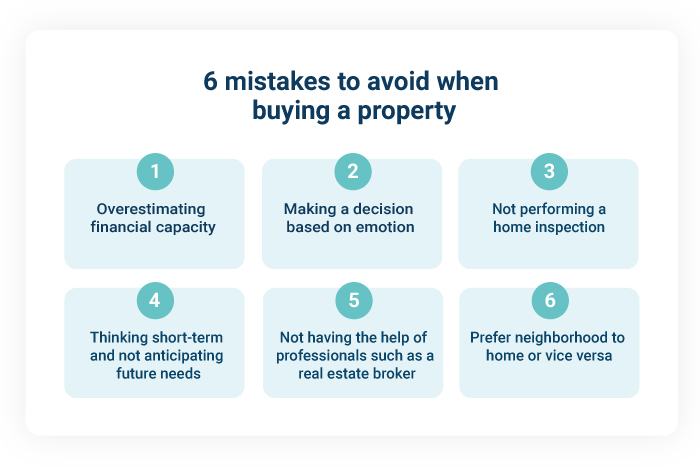

| Tips and tricks Before the showing, drive and walk around the neighbourhood at different times (day, evening, weekdays, weekend). Test out the route to work during rush hour. During the visit, take photos and notes. After the showing, visit other homes to see how they compare. Most importantly, do not make a decision to buy a property purely based on how you feel. |

7. Make an offer or promise to purchase

You have finally found a house and have reached the “promise to purchase” stage, when the buyer makes a formal offer to the seller to purchase their house under certain conditions.

When completing the Promise to purchase form, it is necessary to include the names of the potential buyer and the seller, the address of the property, the proposed purchase price, any inclusions, the possession date, a request for the certificate of location, the expiry date and any other conditions. If you have a real estate broker, they will provide you with the appropriate mandatory form from the OACIQ, the authority of real estate brokerage in Québec. Your broker will also help you fill out the Promise to purchase form correctly.

Once you have made your offer, you must wait for a response from the seller, who may refuse it or make a counter-offer. Be aware that submitting an offer means you are committing to purchasing the property under the proposed conditions.

If your promise to purchase is conditional, you will be required to buy the property once the conditions have been met. For example, if a pre-purchase inspection is one of the conditions and no major defects are found, that condition will have been met. There are a few exceptions that enable you to withdraw from a promise to purchase, but it is far from simple.

What if the seller responds with a counter-offer? This simply means that they want to negotiate certain aspects of your initial offer . Take the time to consider it carefully, but remember to respect the deadline.

8. Get a pre-purchase home inspection

You may be wondering why you should get the house inspected before you buy it. A pre-purchase inspection assesses the overall condition of the property. A qualified inspector can detect problems or defects that may be invisible to the untrained eye. Knowing about existing or potential problems beforehand allows you to make an informed decision about the property you want to purchase. The inspector also provides advice and recommendations on maintenance or needed repairs.

It is important to be aware that the Declarations by the seller form is not a substitute for a proper home inspection.

How much does an inspection cost?

It is up to the buyer to pay for an inspection, which can be between $750 and $850 for a single-family home. However, the price may vary depending on the size, age, number of units and location of the property.

How do I find a (good) building inspector?

A professional inspector is generally a member of a recognized association, such as the Association des inspecteurs en bâtiment du Québec (AIBQ). In order to protect the public, the AIBQ ensures that inspectors meet specific requirements such as having a certificate of college studies and active insurance coverage, using a service agreement, and a host of other criteria.

To find a qualified building inspector, visit the AIBQ website at http://www.aibq.qc.ca.

How is an inspection conducted?

You can accompany the inspector during the inspection. They will be able to explain what they are doing as they go along, and you can ask questions as they arise. For a one-story, single-family home in good condition, an inspection should take approximately 3 hours.

What aspects of the building are inspected?

The inspector starts with the outside (roofing, doors and windows, balconies, stairs, foundation, etc.) before inspecting the inside of the building. They use a comprehensive checklist so that nothing is left out.

Important tip: If you buy during the winter, snow may hinder the inspector’s ability to examine the condition of certain features such as the roof, for example.

The inspection report

The inspection report you receive will include such information as the name of the applicant, the reason for the inspection, the weather conditions at the time of the inspection, the names of those present, a brief description of the building inspected as well as a more detailed analysis.

Legal warranty and hidden defects

Buying a house without a legal warranty means you are waiving certain recourse rights related to concealed issues (hidden defects). A legal warranty protects the buyer against defects that were not detected during the pre-purchase inspection. A sale made “without legal warranty, at the buyer’s own risk” means that you will not be able to sue the seller for a hidden defect.

After the inspection, you will be aware of existing or potential problems. This will allow you to obtain cost estimates for the necessary repairs and determine the additional financial burden that you would need to budget for if you buy the house. You will then be faced with the choice of adjusting the purchase price or withdrawing your offer.

| Tips and tricks Make sure the promise to purchase is conditional on the inspection, i.e., include a clause that will allow you to withdraw if the inspection reveals that major work is needed. |

9. Fill out a mortgage application and learn about mortgage types

A mortgage is a loan secured by real estate. When buying a house, most people cannot immediately pay the full amount. However, a banking institution can lend you the required amount against a deposit (down payment) and a contract (mortgage).

There are the different types of mortgages:

- Traditional mortgage: fixed or variable interest rate, term between a few months and 5 years, and you know the amount of each payment in advance.

- Umbrella mortgage: combines the mortgage loan with other debts and is riskier for the borrower as several assets are used as collateral.

- Private mortgage: offered by private lenders rather than banks, often used by those with a low credit score.

With each type, the interest rate can be variable, fixed, hybrid or combination, and is always based on the key interest rate. Payment frequency may be bi-weekly or monthly, depending on the terms negotiated. The amortization period refers to the length of time it should take to fully repay the loan. Generally, it is between 15 and 25 years. Use our calculator to help you understand the numbers.

Do you know the difference between an open or closed mortgage, a transferable mortgage and a mortgage prepayment?

An open mortgage can be paid off at any time, whereas a closed mortgage has strict terms with respect to the term and payment amounts. A transferable mortgage allows you to transfer the mortgage from one property to another if you move. A mortgage prepayment allows you to pay off the principal faster than anticipated.

As mentioned earlier, if your down payment is less than 20%, you will need to factor the CMHC mortgage loan insurance (mortgage insurance) into the equation. This insurance policy protects the lender in the event that the borrower defaults on payments by guaranteeing repayment of the loan balance with a foreclosure on the property.

Other mortgage insurances to consider are life and disability insurances in addition to home insurance.

| Tips and tricks Getting pre-approved does not guarantee that you will get the mortgage. A mortgage is linked to a property, whereas a pre-approval is solely based on your borrowing capacity. You can help make your dream come true by keeping your finances in good shape between your pre-approval and mortgage application. |

10. Prepare for your appointment with the notary and understand the documents to be signed

It is up to either the buyer or seller to find a notary, depending on their agreement. The notary plays a central role in a real estate transaction: they validate the legal documents, draft the purchase contract (deed of sale), and ensure that all parties understand and accept the terms of the transaction.

In general, the buyer pays the notary fees and fees related to the transfer of ownership. The overall cost will depend on the property value and the complexity of the transaction.

When you go to see the notary, be sure to have the following documents with you:

- Proof of ID

- Bank statements

- Proof of insurance

- Documents indicating your civil status (marital status)

- The complete promise to purchase and ownership documents

Several of the documents will be validated by the notary, including:

- Deed of sale

- Ownership transfer documents

- Property transfer duties

- Statement of adjustment

- Assignment of mortgage agreement

- The title examination

- Inspection report

- Certificate of location

- Title insurance (if needed)

The notary will explain each document in detail to ensure that all parties fully understand the terms of the transaction.

11. Organize your move and take possession of your home

Now that your offer has been accepted, the time has come to prepare for the big move before taking possession of your new home.

Several weeks before the move

- Sort through your belongings and give away what you no longer want

- Get moving boxes

- Book movers or rent a truck and ask family and friends to help with the move

Leading up to moving day

- Pack and label the boxes

- Place valuable or breakable items in a box to bring with you

- Cancel or transfer services (e.g., internet, electricity, phone, etc.)

- Change your address

A few days before

- Confirm the date and time with your moving company or family and friends

- Pack a suitcase with clothes and essentials

- Empty out the fridge or eat whatever is left!

- Double check when the movers will arrive

- Confirm your notary appointment, as this is usually when house keys officially change hands

Did you know that some moving expenses are tax deductible?

Moving day

- Take possession of your new home

- Inspect it and give it a good cleaning

- Enjoy your new (and very big!) purchase

| Tips and tricks To get the best rates for your move, you can use companies that offer a referral service for verified movers such as Moving Waldo . They’ll also coordinate your move dates, advise you every step of the way, and simplify the change-of-address process by centralizing all the paperwork via their Address Change Tool. |

12. Maintain your home and plan renovations

You will inevitably want to make a few improvements on your new home, or even undertake some major renovations. Here is a list of maintenance tasks to plan for and the approximate costs associated with each type of renovation.

Home maintenance

- Regularly inspect your house’s main components

- Clean the eavestroughs

- Maintain heating and air conditioning system (filters, ducts)

- Replace window and door seals

- Touch-up paint

- Clean drains and maintain the septic system (if applicable)

- Check that smoke and carbon monoxide detectors are working

- Prune trees and shrubs, mow lawn

As a rule of thumb, the average annual cost of home maintenance is between 1% and 3% of the home’s value. Of course, that is just an estimate; it also depends on what kind of shape your house is in. One thing is certain: you would be wise to budget for home maintenance. Compile a detailed list of any work that needs doing and allocate a budget.

Home renovations

To avoid costly mistakes, plan a budget before embarking on a renovation project. It is also a good idea to prioritize certain home renovations. If you don’t know it already, you soon will: renovation bills can pile up very quickly! You may find a solution among the various subsidies available! Some renovations are tax deductible. There are also tax credits, like the RénoVert, which can save you money on eco-friendly home renovations.

Wondering which renovations will give you the best return on investment? Focus on the bathrooms and kitchen.

There are a number of home renovation financing options, ranging from personal savings (small renovations) to a personal loan (larger projects), personal line of credit (long-term projects) and mortgage refinancing for major renovations.

One aspect that should not be overlooked is the contractor. Find the right one by consulting directories, requesting quotes or getting help from a renovation consultant. Don’t forget to check the contractor’s RBQ licence, and verify that they have adequate insurance for the types of work you’re doing. When selecting a contractor, be sure to ask for a list of references from previous clients.

The following table contains common home renovations.

|

|

|

|

Interior renovations |

Average cost |

|

Kitchen remodelling |

$18,000–$50,000 |

|

Bathroom renovation |

$14,000–$30,000 |

|

Basement renovation |

$35,000–$75,000 |

|

Replacing flooring |

$1,000–$8,000 per room |

|

Interior painting |

$1,500–$5,000 |

|

Appliance upgrades |

$2,000–$10,000 |

|

Exterior renovations |

Average cost |

|

Roof repair or replacement |

$7,000–$15,000 |

|

Fence installation or repair |

$1,500–$5,000 |

|

Landscaping |

$3,000–$10,000 |

|

Exterior siding |

$14,000–$55,000 |

|

Exterior painting |

$2,000–$10,000 |

|

Window replacement |

$14,000–$21,000 |

| Tips and tricks Carefully planning your renovation projects will help you stay on budget and avoid unpleasant surprises. Experts recommend setting aside between 10% and 20% of the total project budget for contingencies. |

13. Other considerations before buying your home

The real estate market has faced a number of challenges in recent years. Many people have been feeling that homeownership is out of their reach, but lately the market has bounced back with an increase in sales. House prices are relatively stable at the

moment, but they could still fluctuate.

Find your dream home

If your dream is to own a home, go for it! Carefully planning your home-buying project will help you reach your goal. Make your dream come true by following the necessary steps to buying a home and seeking the help of professionals. Start by looking at the properties that are currently on the market.

* While this article provides a comprehensive buyer’s guide, it is important to note that it does not replace personalized professional advice. It is recommended to consult an industry professional for expert advice tailored to your situation before you make any major buying decisions.

Home-buying FAQs

What conditions must I meet to buy a house?

Before you can buy a house, you will need a stable job to guarantee that you can cover your mortgage payments and a sufficient down payment. You must have a good credit score and the financial capacity to pay the related purchase fees.

Can you buy a home when you have no savings?

The first step toward achieving your goal is to create a budget. Find out about government or municipal programs designed to help home buyers. For the down payment, you can explore various options: tap into your RRSPs, ask a relative to help out, consider a condo or obtain a gift of equity.

How much money will I need to set aside before I can buy a home in Canada?

As a general rule, a down payment will amount to 20% of the property’s market value. If you plan to pay less than 20%, you will usually be required to get mortgage loan insurance. In addition to the down payment, experts recommend setting aside 1% to 3% of the purchase price for maintenance costs. Remember to account for the various one-time fees associated with a real estate transaction, including notary fees, moving and connection costs.

See also:

Buying a home: what percentage should I put down?

Pre-purchase inspections: what you should know

6 tips for obtaining or renewing a mortgage